Liquidity Incentives

A description of Swivel's liquidity and market-making incentivization.

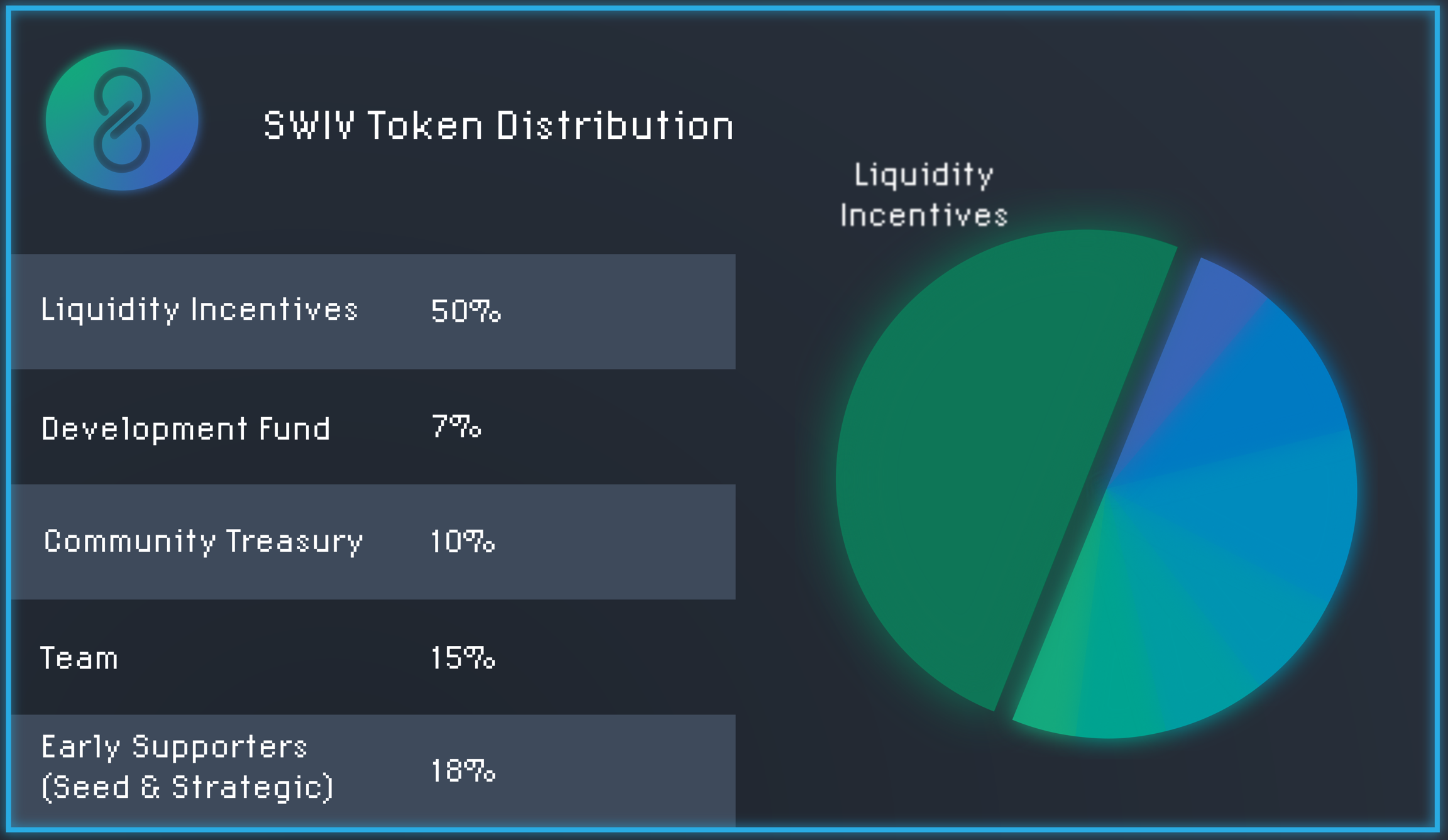

Swivel is the first orderbook-based protocol with liquidity incentives built baseline into token distribution and protocol design.

In the context of an AMM, liquidity incentives are straightforward. Any user who provides pooled liquidity across the constant x*y=k curve is rewarded at a proportional rate for their liquidity provided.

However applied to an orderbook liquidity rewards are not pools but binary orders.

So how does one incentivize an orderbook? By providing token rewards only to those liquidity providers (makers) who's orders are filled.

Swivel sets aside a significant portion of our Liquidity Incentive pool these orderbook incentives.

There are other alternative liquidity incentive implementations using orderbook snapshots as described in Hummingbot's paper on liquidity mining, and as most popularly implemented by dYdX.

While none seem to properly democratize access to rewards across any market participant, we expect that governance will vote to quickly transition to such a design.

Current Liquidity Incentive Distributions

Each market currently has 2,500 SWIV tokens allocated to it on a daily basis and calculated at 23:55 UTC.

Once a day, cumulative volume is calculated, and users are rewarded proportionally based on the amount of YT liquidity they provided to trades.

These rewards are earned on a daily basis and then distributed every 4 week liquidity incentive epoch, starting 2-10-2022.

As shown in the example above, for each market, there are 5,000 SWIV tokens allocated per day.

These tokens are then split proportionally based on the limit orders that have been filled in a given day.

In the example above, 0xmons traded 200,000 of 1,000,000 total YTs that day.

Given they committed 20% of the daily liquidity, 0xmons receives 1,000 SWIV tokens, 20% of the daily allocation.

Effectiveness of Liquidity Incentives: AMM vs CLOB

While liquidity provider token incentives have historically related to providing liquidity on an AMM, it appears that their positive effect on slippage/spread is enhanced within the context of an orderbook.

Effectively, within an orderbook users have individualized capital allocation, and with our liquidity rewards, more efficient competitive capital allocation results in more reward generation.

This then gives market-makers the incentive to not only optimize their capital efficiency, but in doing so undercut one another as they attempt to take on a competitive position within the orderbook.

Last updated